HIPAA-Compliant Accounting Solutions for Senior Living Operators

Navigate senor living finance with confidence

Senior living finance leaders face complexity every day — multi-entity structures, compliance demands, and margin pressure. At Baker Tilly, we don’t just implement Sage Intacct — we chart a smarter course forward. As the number sixth accounting firm in the U.S. and a 12-time Sage Intacct Partner of the Year, we bring deep senior living expertise and technology innovation together to help you outmaneuver complexity, accelerate reporting and deliver lender-ready transparency. Because transformation doesn’t happen by following the same old path — it happens when you dare to go further

Why senior living finance leaders choose Baker Tilly

Why Sage Intacct is ideal for senior care finance

Secure. Compliant. Built for senior living finance

Certified by Avertium for Health Insurance Portability and Accountability Act (HIPAA) and Health Information Technology for Economic and Clinical Health (HITECH) compliance, Sage Intacct gives senior living operators confidence and control. We’re ready to enter a Business Associate Agreement — so your financial data stays secure while you scale.

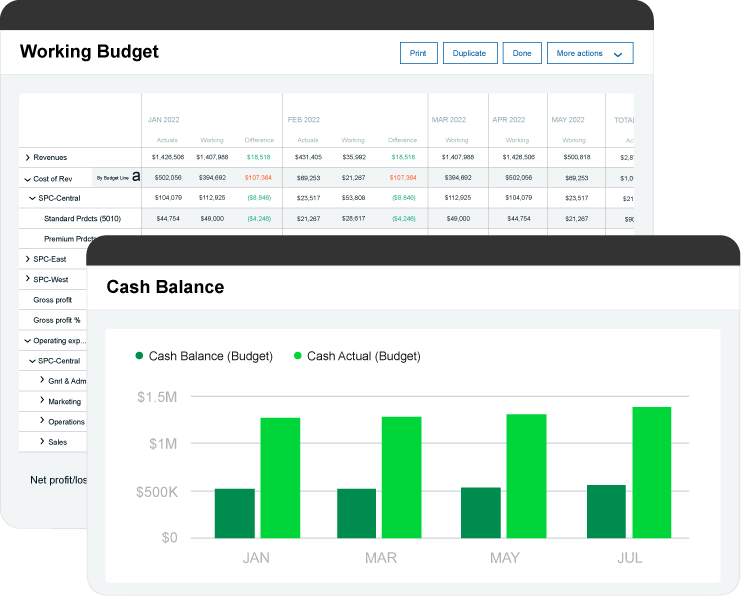

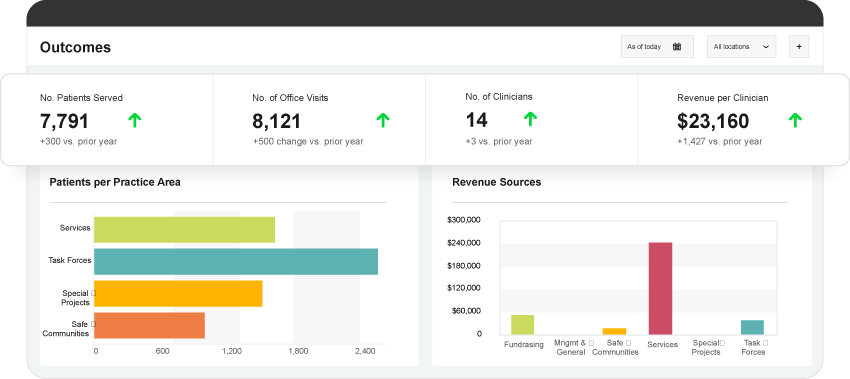

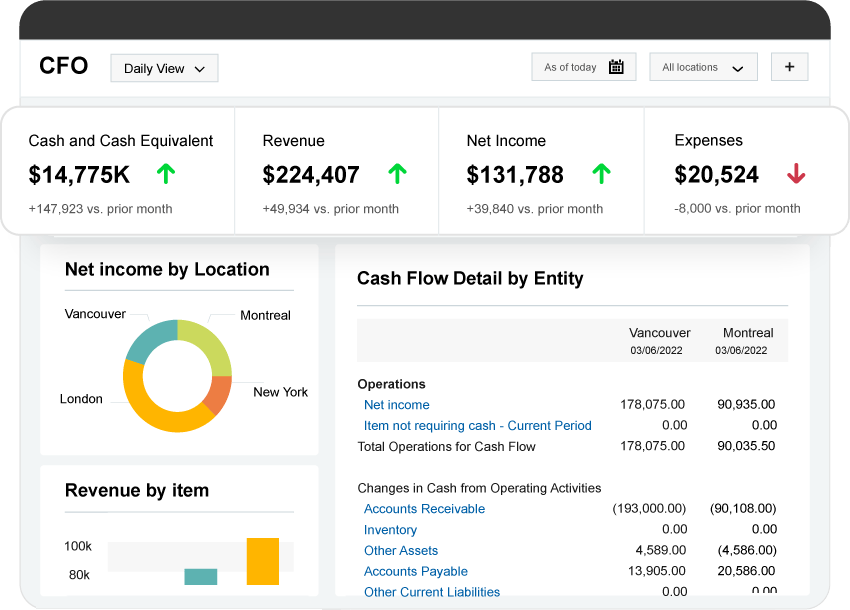

Make faster, smarter decisions with real-time insights

Gain a single source of truth and up-to-the-minute visibility to improve forecasting, optimize budgets and accelerate strategic decisions.

Simplify multi-entity consolidation effortlessly

Sage Intacct supports complex entity structures and multi-currency environments, making it easy to manage growth across locations or business units. With built-in audit trails and centralized reporting, finance teams can produce accurate consolidated statements without the manual effort or risk of errors.

Integrate with ease. Scale without limits

Reduce manual work and lighten your IT load with a secure, multi-entity cloud solution. Sage Intacct connects effortlessly with your existing systems to simplify workflows and support growth — without added complexity. With more than 1,000 integrations (APS, Martus, Ottimate, Procurify and more.) across accounts payable (AP), accounts receivable (AR), procurement, payroll, electronic health record (EHR)/medical billing, budgeting and forecasting, expanding your tech stack is easier than ever.

Speed up your close with advanced automation

Accelerate the month-end close by eliminating manual data entry with intelligent automation. Organizations have reduced close cycles by up to 40%, saving over 400 hours annually, and freeing the finance team to focus on strategic initiatives that drive profitability.

Financial clarity that earns lender confidence

Turn financial clarity into lender trust by accessing real-time net operating income (NOI), automatically connecting census data for greater accuracy and accelerating your month-end close by 40%. Together, these capabilities give your team the transparency and speed needed to build confidence with lenders.

Organizations we serve

- Active living

- Assisted living

- CCRCs

- Independent living

- Memory care

- Skilled nursing