In 2024, the life sciences sector experienced cautious growth driven by strategic acquisitions and collaborations, despite economic headwinds and the uncertainty of the new U.S. presidential administration.

The number of 2024 life sciences initial public offerings increased compared to 2023, reflecting a growing but cautious investor confidence in the sector’s growth potential, although this was far from the record IPO volumes in 2020–2021 and historical trends.

The adoption of generative AI is set to revolutionize drug discovery and development, with significant investment in 2024 and several pivotal clinical results on AI-developed drug candidates planned during 2025. This will serve as validation for AI approaches in drug development leading to significant cost savings and expediting the time from research to commercialization.

The incoming Trump administration is creating uncertainty in the life sciences sector, which will take some time to understand. While market participants anticipate lower taxes and expedited FDA approvals, potential changes in drug pricing and healthcare policy may also present challenges to drug development and commercialization.

Regardless of regulatory and economic uncertainty, life sciences IPOs are set to rebound in 2025 providing the needed funding for companies to advance their clinical trials. For companies looking to take advantage of the IPO window through a first-time registration statement or existing filers making continuous public filings and preparing their next Forms 10-K or 10-Q, insight into past SEC comment letters can help ensure SEC compliance.

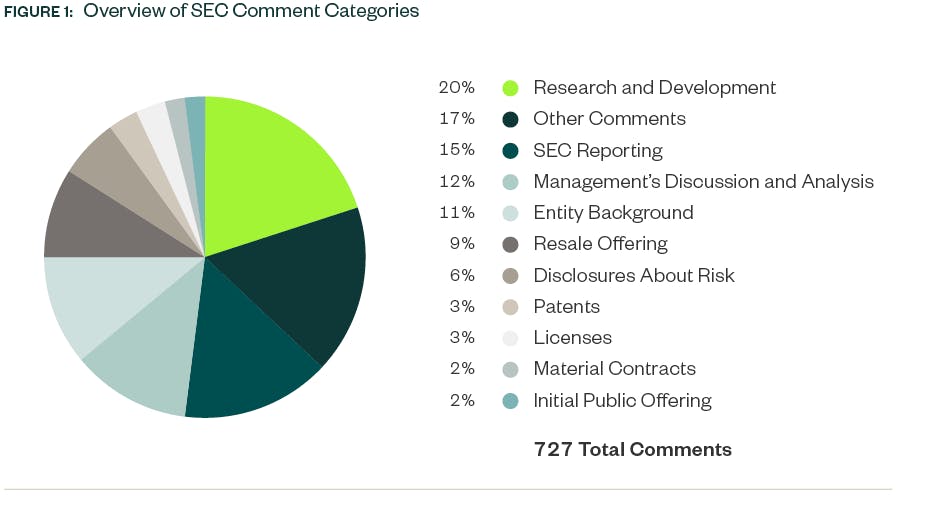

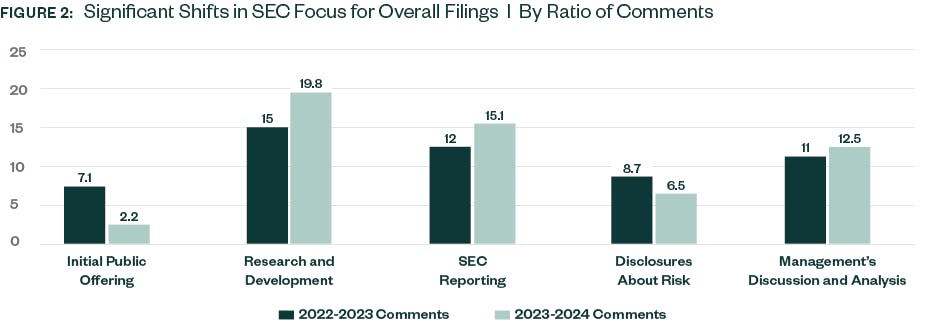

Our report, Under the Microscope: An Analysis of SEC Comment Letter Trends Among Middle-Market and Pre-IPO Life Sciences Companies, looks at SEC comments directed towards Forms S-1, 10-K, 10-Q, and 20-F filings made by life sciences companies during the review period from May 1, 2023, to April 30, 2024 (“2023 to 2024”). Comments were analyzed by frequency to identify the most prominent topics under SEC scrutiny.

Key findings

As in previous years, R&D continued to be the area with the highest number of SEC comments in 2023–2024 with increases from the prior year. The SEC continues to place a heavy emphasis on disclosures surrounding companies’ clinical trials and in-process product development.

Related sections

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.