Historic rehabilitation tax credit

The HTC is an income tax credit equal to 20% of qualified rehabilitation expenditures applicable to income producing buildings that are listed on the national historic registry.

The credit is claimed over a five-year period, 4% each year starting with the year the building is placed in service for a total of 20% over five years. Credits are earned evenly over the compliance period and can be carried back one year and forward 20 years.

Credits can be recaptured if ownership of the property changes or if the property ceases to historically significant during the compliance period.

It takes longer to earn a return from investing in HTC versus ITC. This is because the HTC is a five-year credit — as opposed to the ITC being a one-year credit — however, over time taxpayers can save more with HTC versus with ITC.

In general, there are two different ways to invest in an HTC:

- Single-tier structure, which results in capital gain at exit

- Master-lease structure, which results in a capital loss at exit

Whether you have reliable capital gains or not will largely drive which option is better suited for you.

Single tier

In a single-tier structure, a developer entity holds the historic property and engages in rehabilitation expenditures.

Prior to being placed in service, an investor joins the partnership as a 99.9% owner with the general partner. The investor is allocated the tax credits, income, loss, depreciation, and other tax attributes based on the partnership agreement.

After five years, which is the recapture and compliance period, the investor sells their interest back to the general partner at an agreed upon put price, ranging from 3% to 5% of investment.

The investment amount will generally recognize gain as a result of the basis reduction equal to the amount of the credit and depreciation.

Master lease

In a master-lease structure, there’s a landlord entity, or lessor, that holds the historic property and engages in the rehabilitation expenditures. Generally, the developer owns this entity.

A second entity, the master tenant, or lessee will lease and operate the property. The lessee will accept the investor as the 99.9% owner, like the single-tier structure above, prior to the property being placed in service. The lessor will then make an election to pass through the HTC to the lessee.

Under this structure, the lessee is only allocated the credit, while the lessor retains the other tax attributes. There’s no basis reduction in this structure, but the lessee will recognize income over the depreciable life of the asset — presumably 39 years for real property.

Under IRC Section 50(d), this amount is equal to the amount of excess depreciation resulting from no-basis reduction.

Because basis isn’t reduced and the lessee isn’t allocated other tax attributes, this will likely result in a capital loss as exit when the lessee divests of its interest at the end of the compliance period.

State HTC programs

Many states also have HTC programs and projects that qualify for the federal HTC that likely can also qualify for state HTCs. Additionally, most state HTC programs provide for their credits to be bifurcated from the federal tax credit investor.

In these instances, the project sells the state credits to another party, either as a certificate or through special allocation in a state tax credit fund. State HTCs can also be guaranteed against recapture if the state statute has recapture provisions.

Generally, HTC investment generates between 10%–15% return on equity, whereas internal rate of returns (IRRs) can vary significantly based on when the investment is made.

Low-income housing tax credit (LIHTC)

The LIHTC is a 10-year federal income tax credit equal to 4% or 9% of construction costs. The amount depends on what other federal subsidies are received related to the project, starting with the year the project is placed in service and leased.

The compliance period for LIHTC is 15 years.

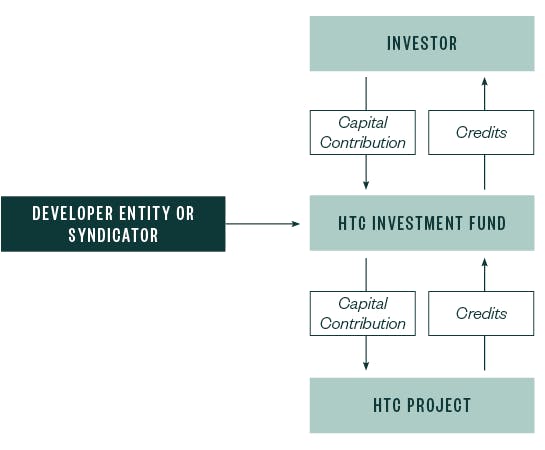

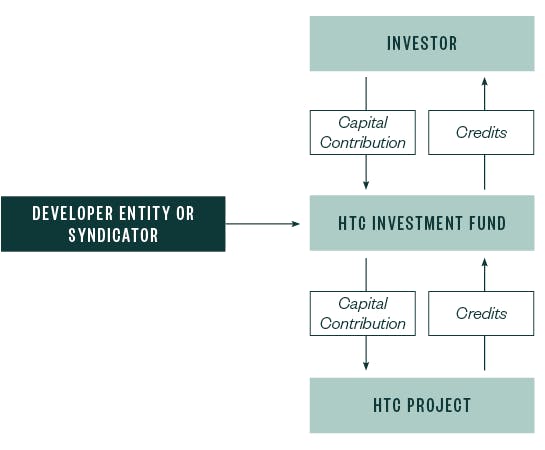

Ways to invest in an LIHTC

Banks and insurance companies tend to be the most active investors in LIHTC. Similar to the HTC structures above, investors in LIHTC projects can invest in one of two ways:

- Directly, with a developer entity through a single-tier structure

- Indirectly, though going through a syndicator that pools together multiple projects into a fund or partnership with admitted investors

State LIHTC programs

Many states have LIHTC programs, and projects that qualify for federal LIHTC likely can also qualify for state LIHTCs. Additionally, most state LIHTC programs allow their credits to be bifurcated from the federal tax credit investor.

In these situations, a project sells the state LIHTC to another party, either annually as they’re earned or in a multiyear strip generally through a state-tax syndication fund. State LIHTCs can be guaranteed against recapture by the seller or by a state tax syndicator.

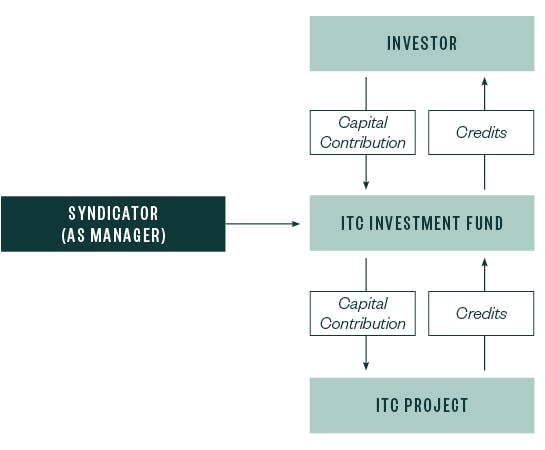

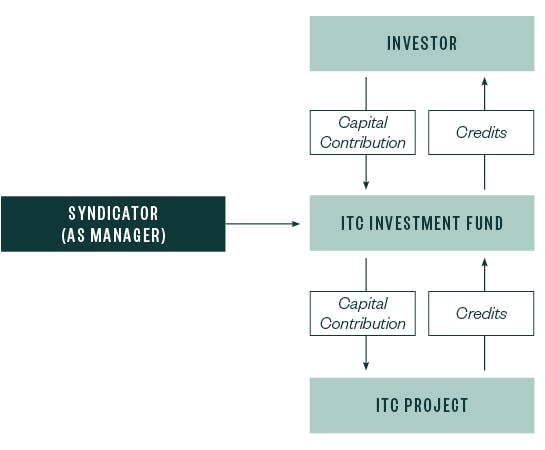

New market tax credits (NMTC) program

The NMTC program is a seven-year federal income tax credit. It’s equal to 5% of the equity investment in the first three years and 6% for the following four years — for a total credit amount of 39%.

To qualify for the credit, a taxpayer must make a qualifying investment in a qualified community development entity that:

- Has already been allocated NMTC

- Makes a qualifying investment in eligible low-income communities and qualifying active businesses in those communities

In general, NMTC investments can produce:

- Above 20% IRRs

- 12%–14% return on investment

Due to receipt of certain tax attributes, such as losses and credits, capital gain is recognized upon exit. When exiting a NMTC structure, the investor typically recognizes a capital gain versus a capital loss that’s seen with the master lease structure and HTC investments.

The enhanced IRR is due to an option to leverage the buy-in over multiple years.