If you’re contemplating a business expansion or job retention project in Texas, it could prove beneficial to consider the Texas Enterprise Zone Program (EZP), a sales-and-use tax refund program meant to encourage private business investment, job creation, and job retention in the state’s more economically distressed areas.

In some instances, projects located outside of enterprise zones could also be approved for benefits as part of related job retention efforts.

Qualifying as an enterprise zone project

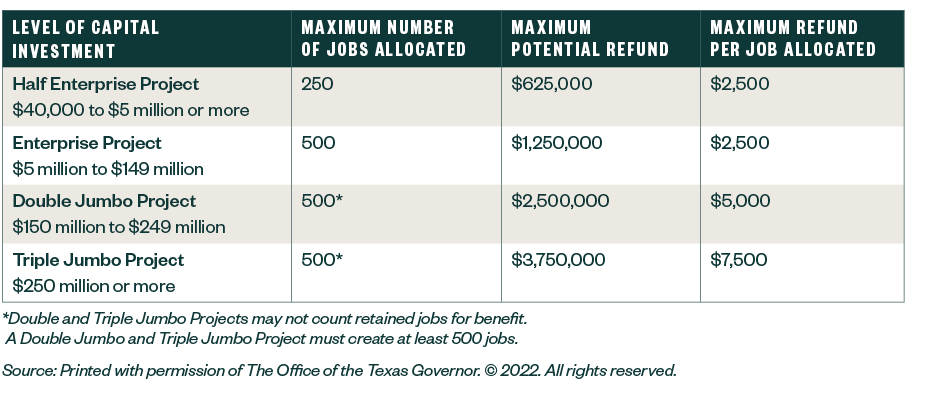

A business could qualify for this tax refund on eligible items for use at the qualified business site for up to a defined amount when the:

- Community designates a business as an enterprise zone project

- Enterprise zone project’s designation is approved by the state

Below are some frequently asked questions that could apply to those looking into enterprise zones.

Who is eligible to apply?

Texas communities must nominate businesses in their jurisdiction to receive an enterprise zone designation.

Upon achieving an enterprise zone designation through a competitive application process from the state, a business is then eligible to receive state sales-and-use tax refunds on qualified expenditures.

A business location outside of any designated enterprise zones could still qualify as an enterprise zone project and receive related benefits, upon approval.

Applications are accepted on a quarterly basis with deadlines falling on the first working day of March, June, September, and December.

The state of Texas allocates a limited number of projects per community. Texas has a maximum of 105 designations per biennium but only approves up to 12 designations per quarterly round, making it increasingly competitive to acquire an enterprise zone designation.

What factors determine an enterprise zone designation?

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.