If your company wants to establish an employee stock ownership plan (ESOP), or has already worked through an ESOP transaction, it’s important to take the time to consider and understand its impact on your organization’s financial statements.

Both ESOP structures, leveraged and non-leveraged, have unique accounting considerations. Learn how ESOPs work and how they can benefit business owners and employees.

Leveraged ESOPs

Most ESOPs start as a leveraged ESOP. In this setup, the ESOP trust borrows money to buy stock from the selling shareholders. Ownership of the shares is transferred to the ESOP but held in a suspense account until the trust makes periodic payments on the loan.

Over time, the trust allocates that stock to ESOP participants as it repays the loan.

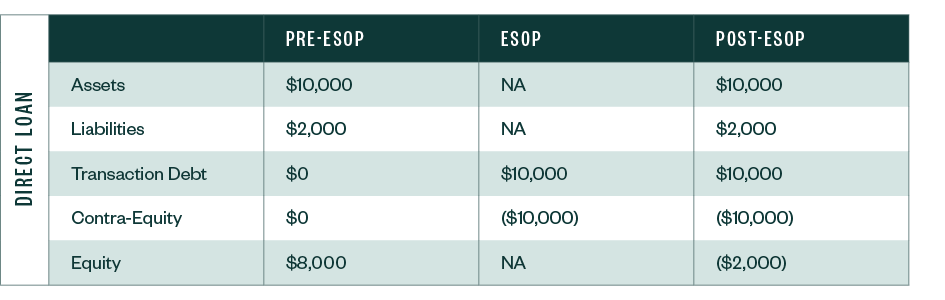

Seller-financed direct loans

A seller-financed direct loan ESOP is when the ESOP trust buys shares directly from a seller in exchange for a note.

Transaction process

The process includes the following steps:

- The selling shareholder sells their shares to the ESOP trust, in exchange for a note. The shares are collateral on the loan and can’t be allocated to participants until they’re unencumbered.

- Each year, the company makes cash contributions to the ESOP to cover the principal and interest on the loan.

- Once the cash is contributed, the ESOP trust can repay the note to the seller.

- Each time the trust makes a payment, that releases shares from suspense because they’re no longer needed for collateral on the loan. The ESOP trust’s recordkeeper can allocate the previously suspended shares to the participant’s retirement account based on the allocation method defined in the plan document for the attribution year.

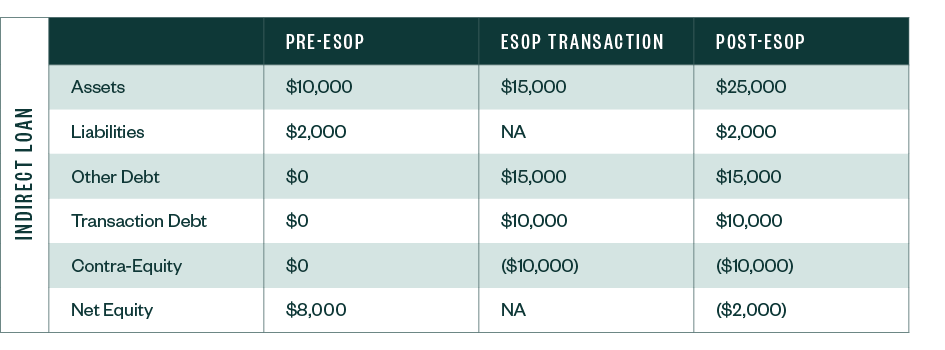

Bank-financed direct loans

A bank-financed direct loan ESOP is very rare but occurs when the ESOP trust borrows money from a bank.

Transaction process

The process includes the following steps:

- The bank lends money directly to the ESOP trust backed by company and shareholder guarantees.

- The ESOP trust can now buy shares from the selling shareholder for cash.