Technology and life sciences companies have many new opportunities to receive federal research grants following the COVID-19 pandemic.

The National Institutes of Health (NIH), U.S. Department of Defense (DOD), and other federal agencies continue to increase funding to technology and life science sectors. This is intended to support technological advancements and pharmaceutical solutions that address COVID-19 and other potential public health threats.

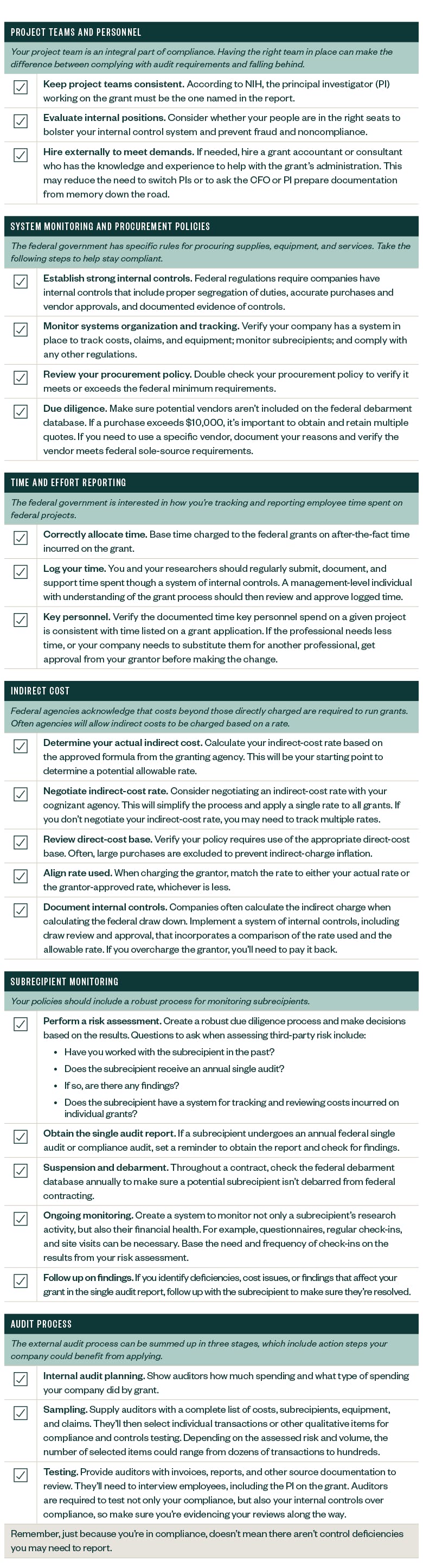

However, before accepting and spending these funds, companies should be aware of the many related compliance requirements. The below federal research grant compliance checklist can help your company benefit from the funding it needs without the compliance issues it doesn’t.

What is grant compliance?

The federal government has long applied compliance requirements to regulate spending of taxpayer funds. These compliance requirements govern everything from the drawing down and spending of funds to the frequency and scope of audits.

They also outline disciplinary actions and ongoing compliance requirements that can affect an entity years after it spends granted funds. Compliance requirements can be significant and differ across federal agencies.

For more insight, read our article covering how to track COVID-19-related expenses and lost revenue for funding compliance.

Why is grant compliance important?

The federal government must view a grant recipient as a good steward of federal dollars. Maintaining compliance with federal government regulations enables companies to not only utilize federal dollars to fund operations, but also continue to apply for these funds and receive awards in the future. Disciplinary actions can be taken as a result of noncompliance, which can range from debarment from future federal funding to audits by a federal agency.

Will my company need to be audited if I accept a federal grant?

Agencies’ audit requirements can differ. However, if a company spends over $750,000 of grant funding in a given year under an individual federal agency, it will likely need an audit of compliance and internal control over compliance for that year. These audits are typically due within nine months of year-end.

How can a company reduce the administrative burden of a federal research grant?

Your company’s processes and policies must be ready to accommodate receiving and managing a federal grant. The administrative burden for a grant is typically higher than that of privately funded grant research.