B2B payments

Deal flow in the B2B payments segment grew steadily for much of the 2010s with a few megadeals in the mix. Like many other segments, deal value skyrocketed in 2021 and stayed elevated in 2022 until normalizing again in 2023 with a decline of more than one-half.

Digitization of enterprise infrastructure accelerated during the pandemic, and private investment in the space grew by more than 50% in 2020 and then more than doubled in 2021.

The launch of the U.S. FedNow pilot program in mid-2023 underscores the demand for instant payment schemes among depository institutions and their customers. A faster underlying foundation for interbank exchanges will take time to implement and troubleshoot but will eventually benefit both institutions and individuals in terms of settlement speed and cost.

Automation and AI are also driving changes in the payments space, with use cases including more efficient customer service and fraud detection. These factors, along with the surge in activity that played out during the pandemic, will shape the segment’s development over the next several quarters as invested capital is put to work. That said, new investment into the space slowed in 2023 and may remain muted until macroeconomic tides begin to shift.

Consolidation on the horizon

The ebb and flow of industry consolidation continues. On one hand, financial services behemoths are grappling with decentralized products and currencies, greater geopolitical fragmentation, and renewed vigor in criticisms of long-standing oligopolistic fee structures like Visa and Mastercard, which recently took a legal blow that will result in lower fee income over five years, pending court approval. Conversely, banks and traditional institutions remain relatively fortified with massive balance sheets and highly developed infrastructure and payment networks.

Privately invested capital has become more concentrated among major investors as well, and contraction in multiples since 2021 has created stress among many start-ups that now may be more likely to pursue a sale to an incumbent or competitor at a discount. In this environment, fintechs aiming for fundamental industry disruption face greater hurdles than those inclined to integrate with an existing major player, given continued VC headwinds.

Exit opportunities for the latter group remain more fruitful, though targets appear to balk at purchase prices, resulting in double-digit percentage declines in exit count for that category for the past two years.

As the dust settles after two years of slower dealmaking and interest rates begin to drop, the fintech space will likely start to see a wave of consolidation through strategic M&A transactions. Acquisitions remain the most common exit type for fintechs as new public listings struggle to break through early trading difficulties.

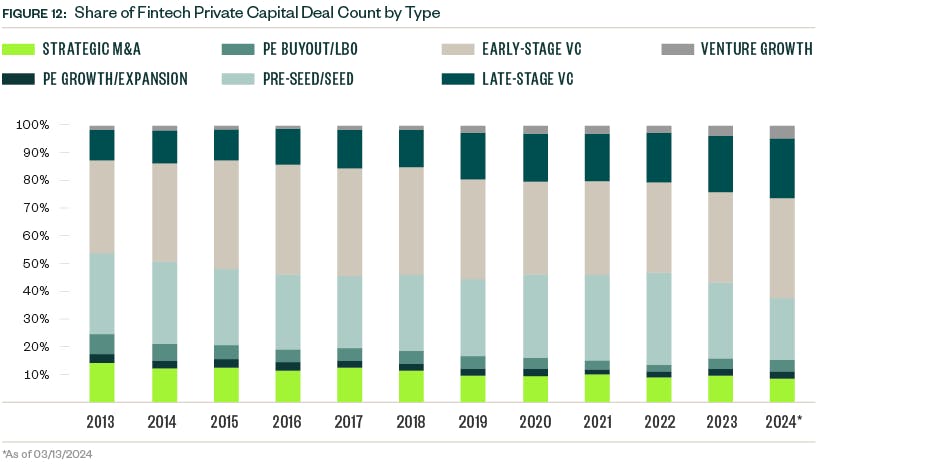

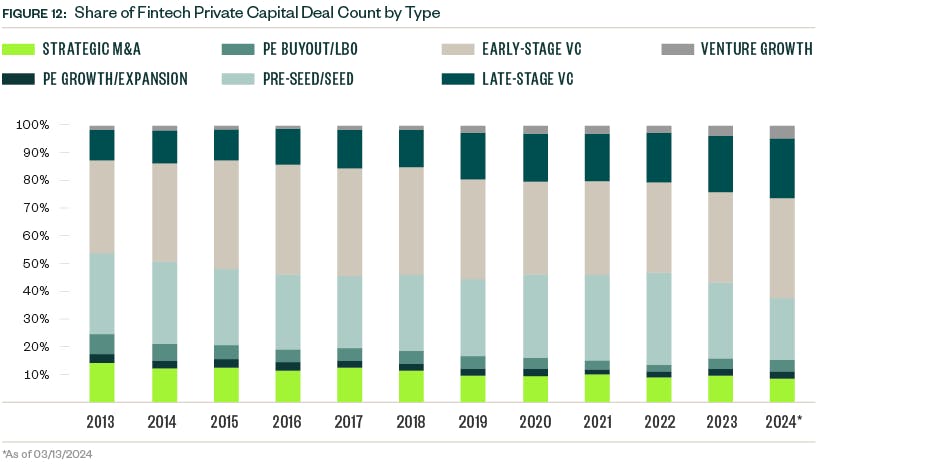

Slower new deal flow and smaller financing sizes in the late-stage VC category may slow the pipeline of public listings further, but resiliency in the earlier stages combined with cautious optimism regarding IPO prospects could see more companies pursuing this exit route. PE firms also maintain an interest in fintech, with consistent levels of both buyout and growth or expansion deals since 2021, when firms materially increased their footprint in the space.

Fintech’s frontier

Three major themes will shape fintech’s direction over the coming quarters:

- Proliferation of transformational next-generation technologies, namely AI and auxiliary capabilities

- Socioeconomic-driven changes in consumer financial behavior

- Regulatory directives

Agility is key for financial services firms to adjust to these changes, which create opportunities for fintech players to provide support and integrate themselves into the broader financial system. With financial fraud on the rise and cybersecurity needs expanding largely due to AI, institutions require faster, more efficient controls.

Consumer demands, including faster payment processing and personalization, raise the stakes for these controls as well. The biggest catalyst for upcoming change in the financial sector is arguably the direction of interest rate policies, with several global powerhouses on the precipice of rate cuts in 2024 following drawn-out battles against inflation.

The effects of inflation linger with rising use of buy-now-pay-later products and consumer debt among concerns for certain lenders and regulators. Legal proceedings against cryptocurrency platforms will impact dealmakers as well. There are several key risks facing fintechs, but outsourcing innovation remains a valuable lever for large incumbents to pull, especially in times of uncertainty.

The wait-and-see approach that many investors took over the past two years is beginning to wane, with slower fundraising and tighter liquidity contributing to mounting pressures. 2024 will likely mark key developments in the financial services industry, and private dealmaking in fintech will respond in kind.

Methodology

Fintech, cryptocurrency, insurtech, and B2B payments within this publication were defined using the PitchBook verticals for each. Lending was defined using a mix of relevant keywords that had to be contained within the company’s profile.

Companies in the underlying population had to have at least one of those industry codes tagged as their primary industry code. Standard PitchBook methodology regarding venture transactions and venture-backed exits was used for all datasets, and similarly for PE or other private investment types. Full details can be found here.