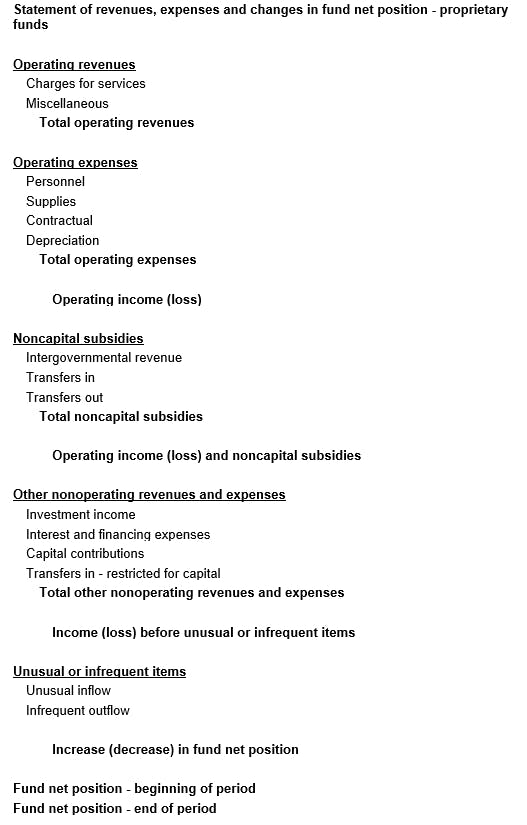

In part one of this series, we discussed the history of Governmental Accounting Standards Board (GASB) statement no. 103, financial reporting model improvements, as well as enhanced guidance related to the management’s discussion and analysis (MD&A) section of the financial statements. This installment will focus on the changes to the statement of revenues, expenses and changes in fund net position for proprietary funds.

The statement of revenues, expenses and changes in fund net position for proprietary funds is intended to show the inflows and outflows for the period. Given the emphasis of proprietary fund activity is on the operations, it is appropriate that GASB wants this statement to define revenues and expenses of operating activities and non-operating activities. In addition, the guidance in GASB 103 paragraphs 11-14 provides a new category of activity called subsidies, and a new structure for the statement of revenues, expenses and changes in fund net position.

Let’s start with the new definitions:

- Non-operating revenues and expenses* include:

- Subsidies (defined below)

- Contributions to permanent or term endowments

- Revenues and expenses related to financing

- Resources from the disposal of capital assets and inventory

- Investment income or expenses

Operating revenues and expenses: All items that don’t meet the definition of non-operating above, as long as they are not unusual or infrequent items.

* If the principal ongoing operations of a proprietary fund include transactions that would normally be nonoperating as defined by GASB 103, those transactions should be reported as operating in that situation.

Subsidies include:

- Resources received from another party or fund which are non-exchange (the proprietary fund does not provide goods or services) and that directly or indirectly keep the current or future fees/charges of the proprietary fund lower than they otherwise would be