Equity compensation continues to be a popular strategy for companies to attract highly qualified candidates, boost employee engagement, and secure tax savings.

Many companies, optimistic about these benefits, start equity compensation programs without sufficient planning. They’re often surprised to discover the nuanced accounting requirements involved — and the operational systems needed for a program to run smoothly.

Knowing and planning for these potential roadblocks in advance can help companies reap the significant benefits equity compensation has to offer while avoiding the negative consequence that can arise.

The article addresses the following:

- What is an equity compensation program?

- What are the benefits of an equity compensation program?

- What are the types of equity compensation?

- What are the tax implications of equity-based compensation?

- What is mobility taxation?

- What are the challenges of mobility taxation?

- How can an organization plan for mobility taxation?

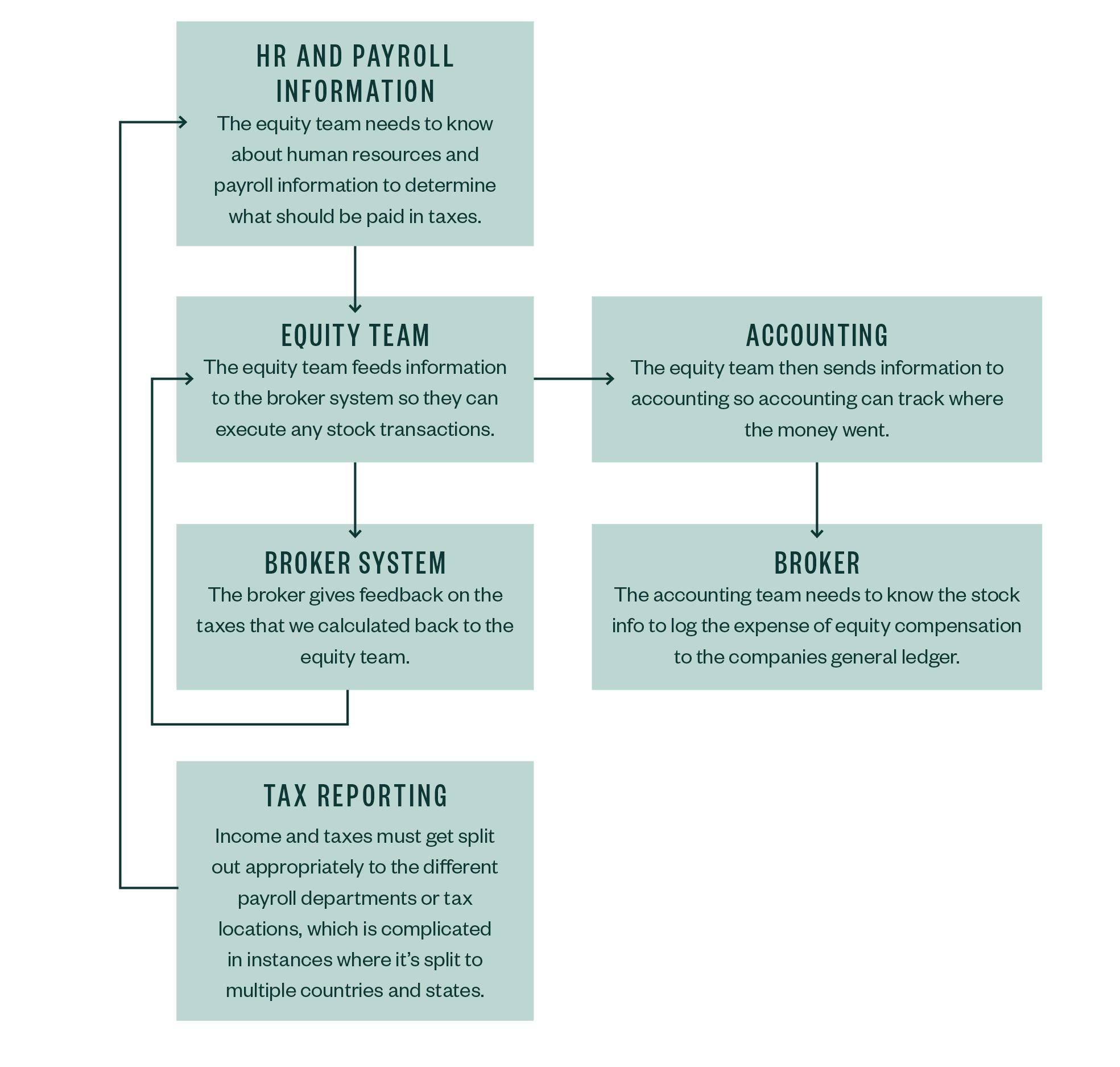

- How does payroll reconciliation affect the process flow of equity compensation?

- What are the challenges of payroll reconciliation?

- How can an organization plan for payroll reconciliation?

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.