Many U.S. business owners, especially those that manufacture in the U.S. and sell outside the U.S., don’t take advantage of the available U.S. income tax export incentives. Given these tax breaks could result in a significant reduction in the federal income tax rate on exports, business owners would be well-served to evaluate the potential tax savings available to their businesses.

Any U.S. business owner who exports may be able to utilize the interest-charge domestic international sales corporation (IC-DISC) or the foreign-derived intangible income (FDII) incentives.

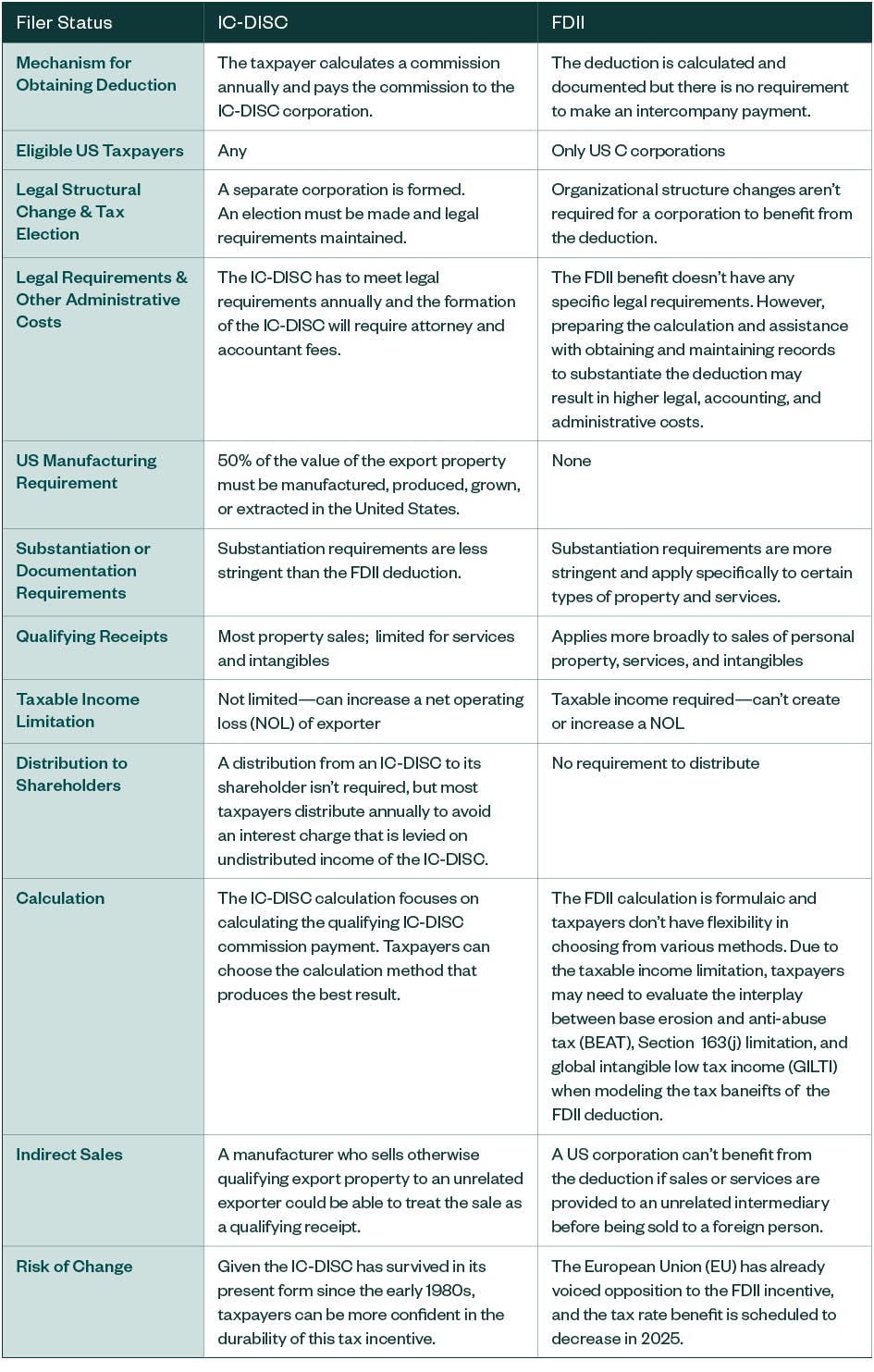

Below is a breakdown and comparison of each incentive including scenarios where both could be applicable in the same tax year.

How can a taxpayer use the IC-DISC incentive?

An IC-DISC is a U.S. domestic corporation that meets certain requirements under U.S. tax law and has made a valid IC-DISC election.

The IC-DISC incentive is available to almost any U.S. taxpayer — individuals, C Corporations, S Corporations, partnerships, or LLCs — as long as they have qualifying exports.

A taxpayer who has established an IC-DISC annually identifies their qualifying exports and calculates a commission payment to the IC-DISC. Taxpayers have flexibility to choose the commission payment calculation method that provides the highest tax savings.

Taxpayers need to consider the following steps for the IC-DISC incentive:

- Determine if they have products that are qualifying exports — generally 50% or greater U.S. manufactured or produced goods or services.

- Review historical financial information, and prepare an estimate of the tax benefit.

- Organize a U.S. corporation that meets the formal legal requirements for an IC-DISC election.

- On an annual basis, calculate the qualifying commission payment to the IC-DISC.

When calculating the potential cash-savings, taxpayers should also consider the legal and maintenance costs of an IC-DISC.

How can a taxpayer use the FDII incentive?

Qualifying U.S. corporations organized in the U.S. can take advantage of the FDII deduction. The deduction is only available for tax years beginning after Dec. 31, 2017.

To the extent a U.S. corporation can substantiate its qualifying income — earned from the sale of property or services provided for foreign use or for royalties for intellectual property used outside the U.S. — that income may benefit from a 37.5% deduction. The deduction is scheduled to decrease to 21.875% in 2025.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.