For the most up-to-date content on recent fires, see our Tax Planning Guide’s Disaster relief section.

Following the emergency disaster declaration issued by the Federal Emergency Management Agency (FEMA) for the severe wildfires impacting the greater Los Angeles area, the IRS announced tax filing and payment deadline relief for affected taxpayers.

The IRS guidance provides that affected taxpayers have until Oct. 15, 2025, to file individual and business tax returns and make tax payments. California also offered similar relief for state taxes.

Affected taxpayers

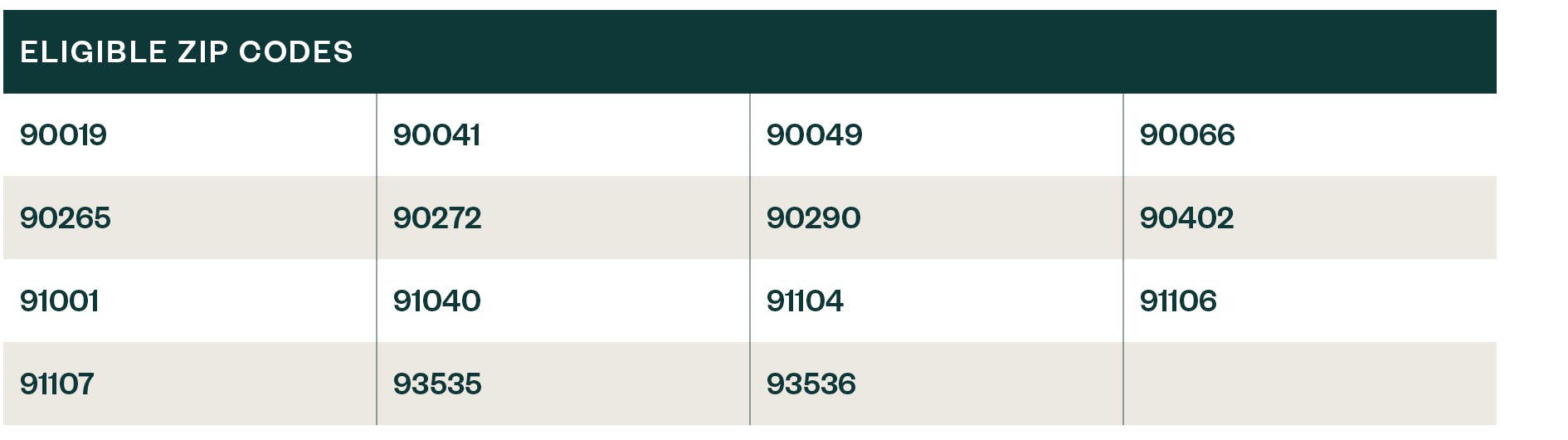

All individual taxpayers who reside and businesses whose principal place of business is in the covered disaster areas qualify for the federal deadline relief. Covered disaster areas include any area designated by FEMA. This currently includes Los Angeles County. Additional counties could be added later. Visit the FEMA site for updates.

The IRS will automatically identify taxpayers located in the covered disaster area and will apply filing and payment relief. Impacted taxpayers who reside or have a business located outside the covered area should call the IRS disaster hotline at 866-562-5227 to request relief.

Federal filing and payment relief

The relief applies to various individual and business returns and tax payments that have either an original or extended due date occurring from Jan. 7, 2025, through Oct. 15, 2025, including:

- Quarterly estimated tax payments normally due between Jan. 7, 2025, and Oct. 15, 2025

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.