The IRS published Notice 2023-17, which provides guidance and establishes the program to allocate bonus credit percentages for the environmental justice solar and wind capacity limitation under the Inflation Reduction Act, on Feb. 13, 2023.

Goals of environmental justice bonus credit

The environmental justice solar and wind capacity limitation (sometimes referred to as the environmental justice bonus credit or low-income communities bonus credit) allows a taxpayer or applicable entity to be eligible for direct pay under Internal Revenue Code (IRC) Section 6417.

It allows qualifying projects to receive an increased tax credit between 10 and 20 percentage points on top of the tax credit percentage applicable to projects meeting other bonus criteria, such as prevailing wage and apprenticeship requirements.

The broad goals of the credit are to:

- Increase access to renewable energy facilities in low-income communities with environmental justice concerns

- Encourage new market participants

- Provide social and economic benefits to those who have been historically overburdened with pollution, adverse human health, or environmental effects, and marginalized from economic opportunities

Qualifications for environmental justice bonus credit

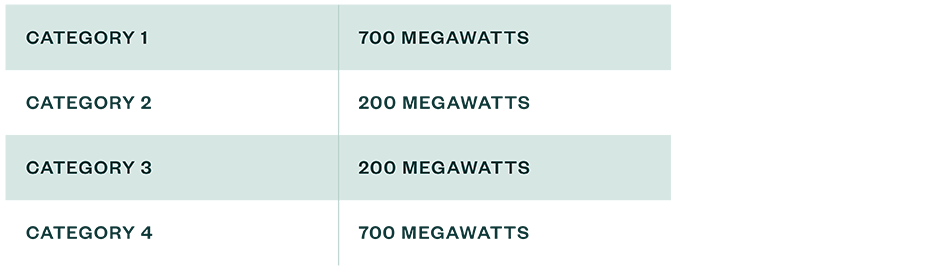

To be eligible for the program, applicable entities must be allocated a portion of the available environmental justice solar and wind capacity limitation. The applying solar or wind project must also be treated as energy property under IRC Section 48, generate electricity solely from a wind facility, solar energy property or small wind energy property, have a maximum net output of less than five megawatts alternating current, and be described in at least one of the four following categories:

Category one

The facility is located in a low-income community, which is generally defined under IRC Section 45D as a census tract with a poverty rate of at least 20% or in a census tract with a median family income that doesn’t exceed 80% of the metropolitan or statewide median family income, as applicable.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.