Qualified improvement properties (QIPs), which encompass many improvements made to existing commercial buildings, are now depreciated over 15 years and are eligible for bonus depreciation due to the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Improvement assets are a big part of many businesses — especially retailers and restaurants that are always performing refresh remodels and opening new locations. These favorable depreciation changes to QIP can provide many taxpayers with the opportunity to increase depreciation losses and defer current federal tax liabilities, providing immediate cash flow relief. Below, we’ll outline what QIP is, how to approach depreciation changes for improvement assets placed into service in 2018 and 2019, and key considerations.

What is qualified improvement property?

QIP was first introduced by Congress in 2015. Like the improvement property classifications before it, the purpose of QIP was to incentivize improvements to existing commercial buildings in exchange for accelerated tax depreciation benefits. For eligible improvement assets in service in 2016 through 2017, taxpayers could generally claim bonus depreciation on the QIP assets.

QIP includes interior and nonstructural improvements made to existing nonresidential buildings. However, it doesn’t include improvement expenditures related to elevators, escalators, structural modifications, or physical expansions of the building.

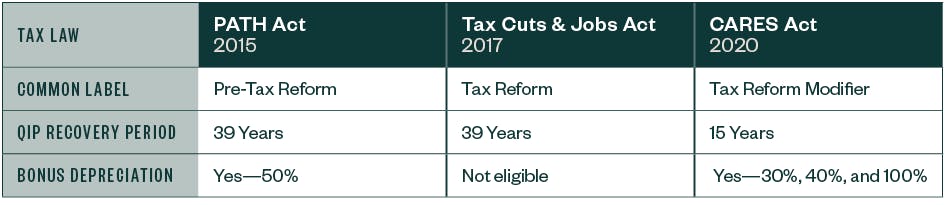

Although tax reform, often referred to as the Tax Cuts and Jobs Act of 2017 (TCJA), intended QIP to be 15-year depreciable property and eligible for bonus depreciation, a technical drafting error rendered it 39-year property. For any QIP assets placed into service in 2018 and 2019, taxpayers were stuck depreciating the entire cost of QIP assets similar to a building, over 39 years and with no bonus depreciation.

Changes under the CARES act

The CARES Act addressed the technical drafting error and now allows QIP assets to be depreciated over 15 years, making them eligible for bonus depreciation. These changes retroactively apply to assets placed into service in 2018. The IRS has released procedures for addressing and approaching depreciation changes for QIP assets in service in 2018 and 2019 for returns that have already been filed.

The table below illustrates the changes to QIP since introduced in 2015:

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.