In the advent of volatile global conditions and stricter crisis management, the drive toward compliance is greater than ever. One such area stems from IPO filings required by the SEC.

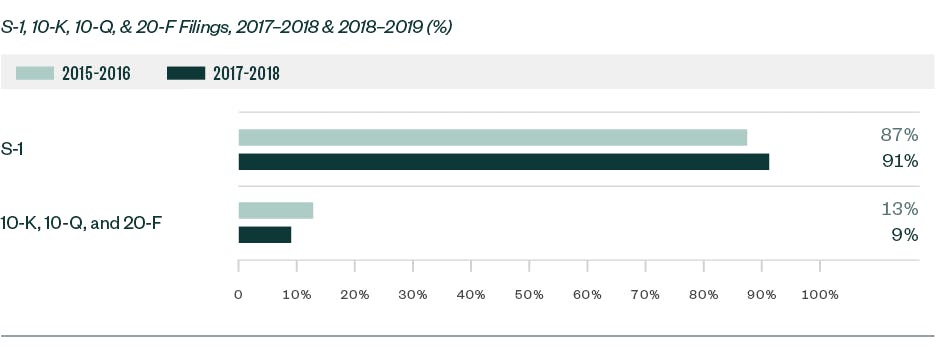

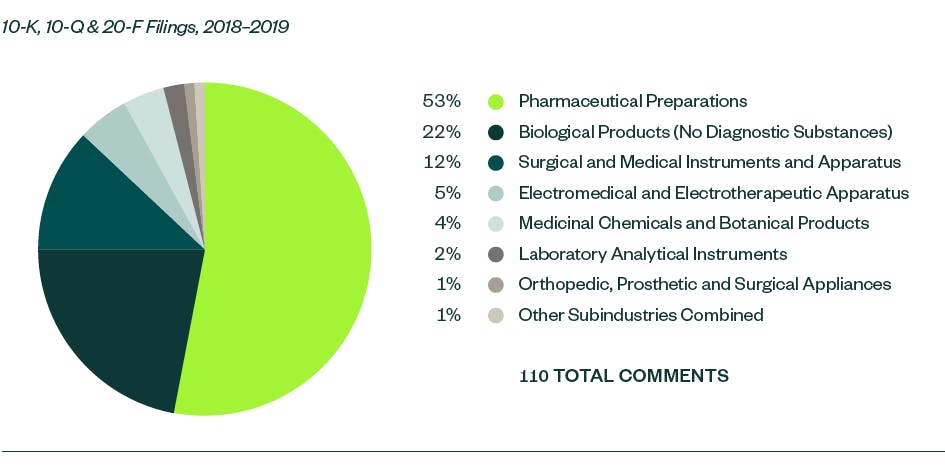

In our report, Under the Microscope: An Analysis and Report of SEC Comment-Letter Trends Among Middle-Market and Pre-IPO Life Sciences Companies, we looked at S-1, 10-K, 10-Q, and 20-F filings made by life sciences companies during a 12-month review period from May 1, 2018, to April 30, 2019. Comments were analyzed by frequency to identify the topics that fell under repeated SEC scrutiny.

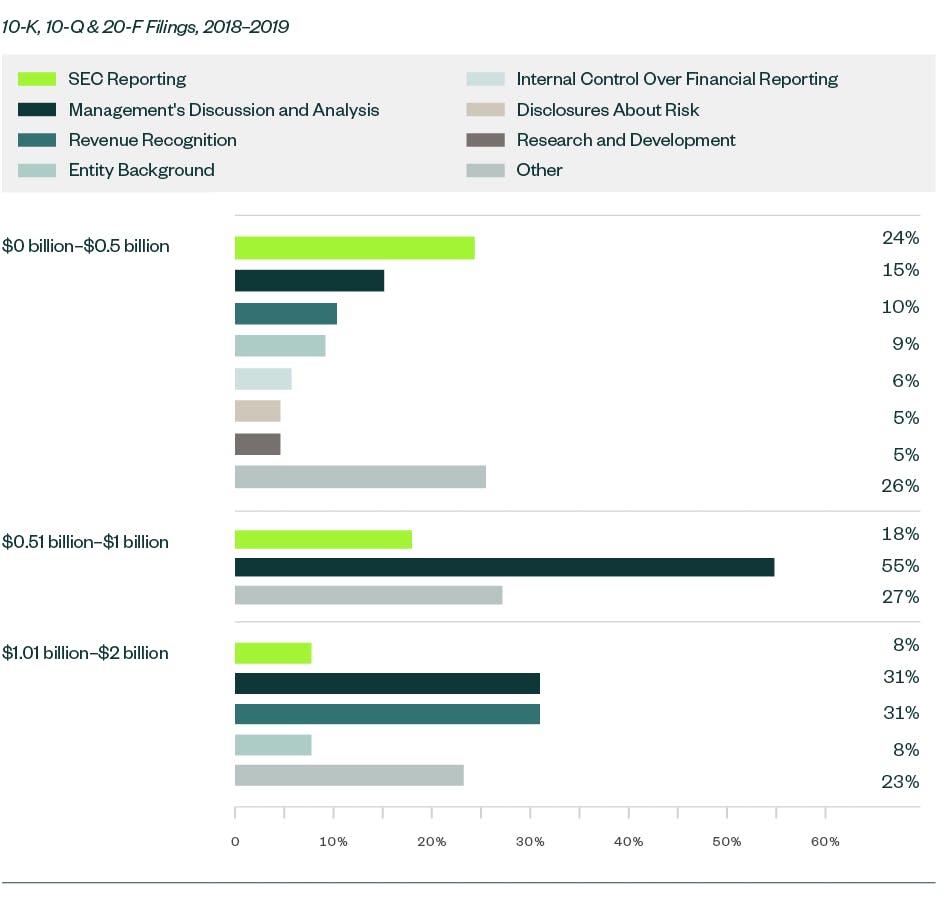

Comments related to SEC reporting tend to be more administrative and formulaic, but because of the sheer volume of such comments, companies could significantly reduce filing delays by understanding the nature of scrutiny surrounding these comments and taking the appropriate steps to comply.

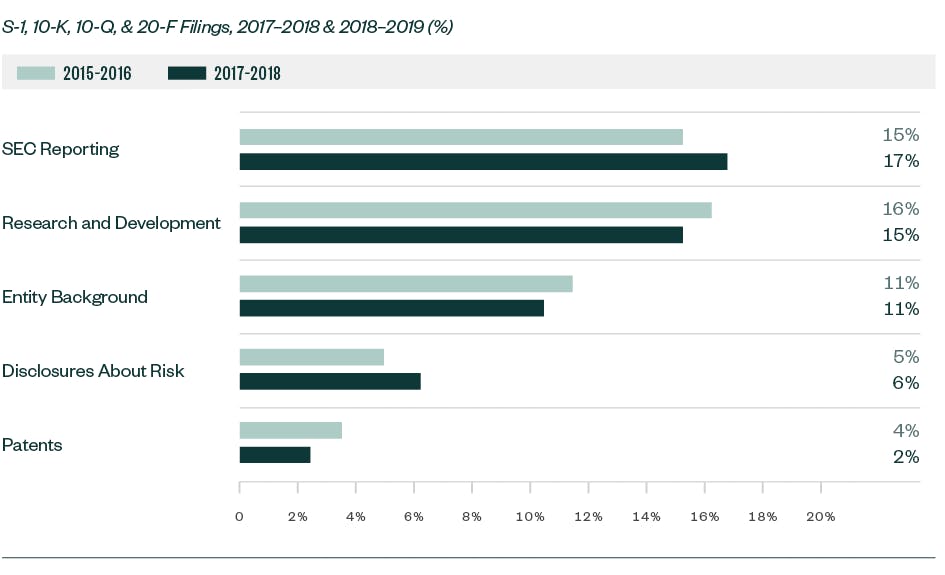

While comments related to R&D continued to remain significant, they saw a slight decline compared with our report from 2017 and 2018. R&D comments typically relate to clinical trials and studies, U.S. Food and Drug Administration (FDA) filings and communication, product pipeline, products and services, and other highly firm-specific information.

Meanwhile, there was an increase in focus on comments related to process compliance, which constitutes the largest category of SEC comments in 2018 and 2019. Other recurring comments include those related to emerging growth companies, controls and procedures, revenue recognition, and material contracts.

Overall findings

Comment categories

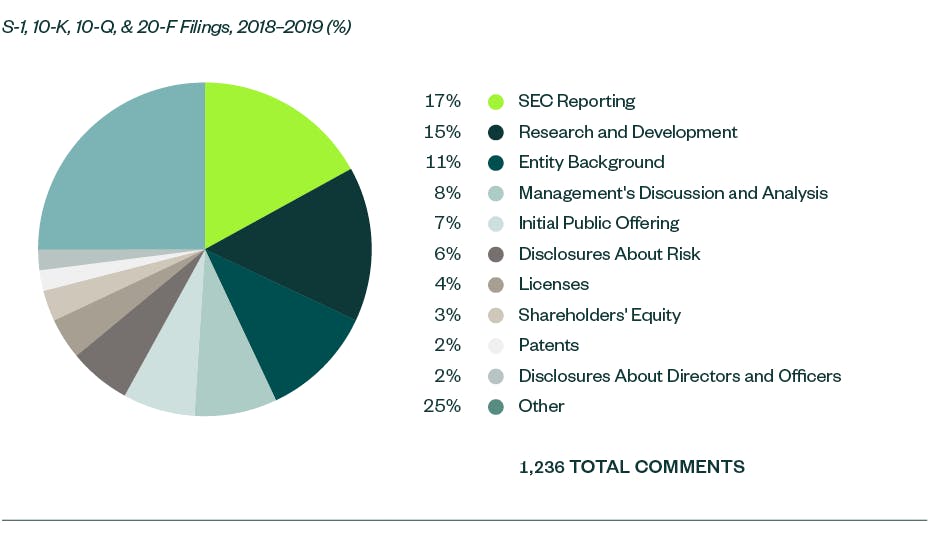

There were 1,236 SEC comments in the S-1, 10-K, 10-Q, and 20-F filings made by life science companies that were reviewed in the report for 2018 and 2019. These were largely spread across several key categories — comments related to SEC Reporting, or process compliance, were the most prominent garnering a 16.7% share.

R&D was the next major category with a share of 15.3%. The majority of those comments were directed toward companies’ clinical trials and studies, similar to the SEC comments in 2017 and 2018. This was followed by comments requiring disclosure on entity-background, management’s discussion and analysis (MD&A), the actual offering, as well as any current or anticipated risks related to the registrant’s business.