Since Congress created interest-charge domestic international sales corporations (IC-DISCs) in the 1970s, they’ve fallen into and out of favor as tax laws evolved. While popular since 2004, significant changes to the U.S. tax system have varied the benefits of an IC-DISC in the years since.

The enactment of The Tax Cuts and Jobs Act (TCJA) in 2017 brought with it a 20% qualified business income (QBI) deduction for certain pass-through entity business owners, reducing the tax rate arbitrage exploited by the IC-DISC.

Their popularity has slipped slightly due to the 3.8% net investment income tax rate on qualified dividends — the type of income IC-DISCs can generate. But there’s a way to offset the effect of these changes and increase the benefits of using an IC-DISC: by increasing its income through accounts receivable (A/R) factoring.

What’s an IC-DISC?

IC-DISCs are IRS-approved corporations set up by exporting companies. If your business exports goods it has manufactured, produced, grown, or extracted, setting up an IC-DISC could yield permanent tax savings.

How IC-DISCs work

An IC-DISC charges its exporting company a commission on the exporting company’s qualified export sales. The IC-DISC itself isn’t required to pay tax on the commission income. Generally, the IC-DISC then distributes its income back to its owners in the form of a qualified dividend. The individuals who are shareholders in an IC-DISC — either directly or indirectly, through a pass-through entity such as a partnership or S corporation — then pay tax on that income at the beneficial qualified dividend rate.

While the IC-DISC can also be owned by a C corporation, individuals that directly own the IC-DISC stand to benefit most.

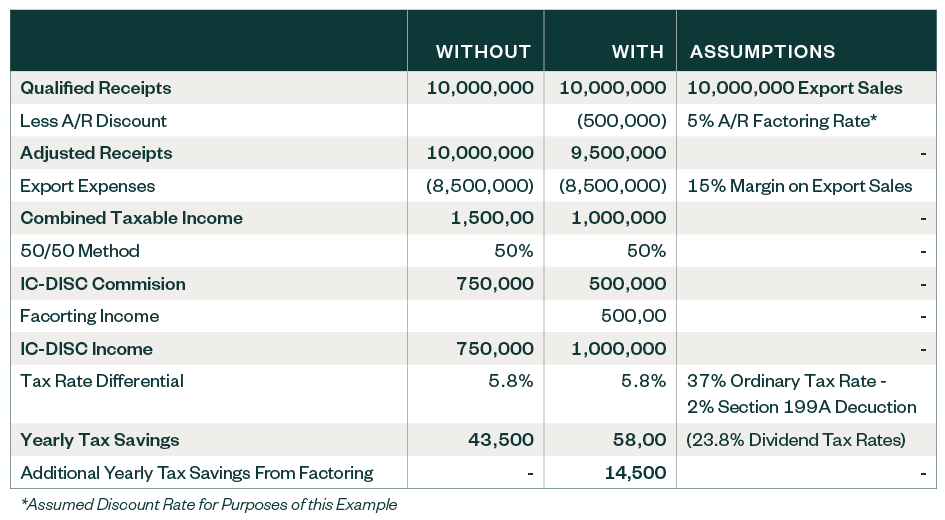

Consequently, individual taxpayers in the highest tax bracket can reduce their tax rate from 37% to 23.8% on a portion of their qualifying export profit. When the 20% QBI deduction under Section 199A is factored in, this results in a minimum benefit of 5.8%. For many exporters, this amounts to significant annual tax savings.

If your business already has an IC-DISC and has at least $10 million of export sales, you could be leaving money on the table if you aren’t also taking advantage of A/R factoring. This kind of arrangement can help further reduce the overall taxes you owe.

A/R factoring

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.