With the passing of The Tax Cuts and Jobs Act (TCJA) in December 2017, there have been significant changes in tax law, the majority of which are effective for the 2018 tax year. This is part one in a four-part series on the most significant changes in tax law that will impact the dental industry, considerations for practices and individual tax situations for dentists.

Individuals

Outlined below are some of the key changes affecting individuals and considerations to be aware of when planning.

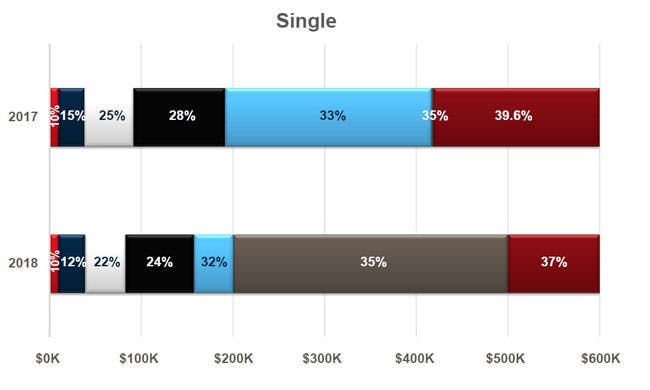

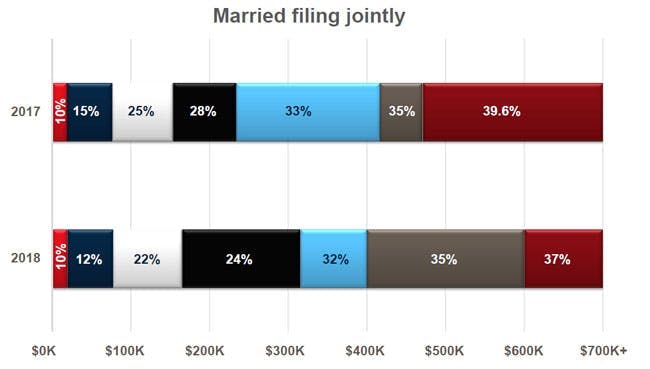

The two most significant changes to the tax bracket for both married filing jointly and single taxpayers are in the reduction of the top rate to 37 percent from 39.6 percent and the general widening of each tax bracket (graphs below).

The alternative minimum tax (AMT) saw a change with the increase of the exemption amount and phase-out thresholds. This will likely result in far fewer taxpayers being subject to AMT in 2018 and beyond. The new limitations of the state and local tax deduction will also lead to fewer taxpayers being subject to AMT.

The standard deduction was doubled for married filing jointly taxpayers to $24,000 and single taxpayers to $12,000. As a result of this change, personal exemptions are suspended until 2026. In addition, other changes to itemized deductions include suspending the following items until 2026:

- Real estate and state income tax deductions are limited to $10,000

- Mortgage interest deductions are limited to interest incurred on indebtedness of $750,000 for debt incurred after Dec. 31, 2017; home equity interest is now disallowed

- Miscellaneous itemized deductions, including unreimbursed employee business expenses and investment advisory fees, were eliminated

As for estate-planning considerations, alimony is no longer deductible for divorce/separation agreements finalized after 2018, and the estate tax limit doubled to approximately $11 million per individual. Additionally, the child tax credit was doubled to $2,000 and the income phase-out for the credit now begins at $200,000 for single taxpayers and $400,000 for married taxpayers.