In the ever-evolving landscape of financial reporting and compliance, understanding trends in material weaknesses is crucial for organizations aiming to maintain robust internal controls.

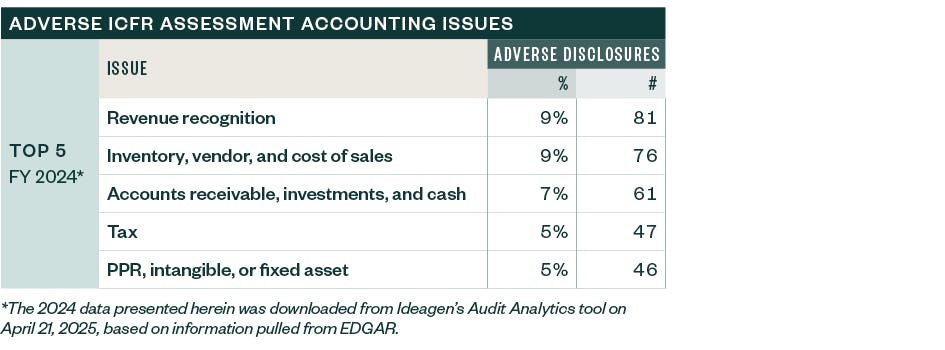

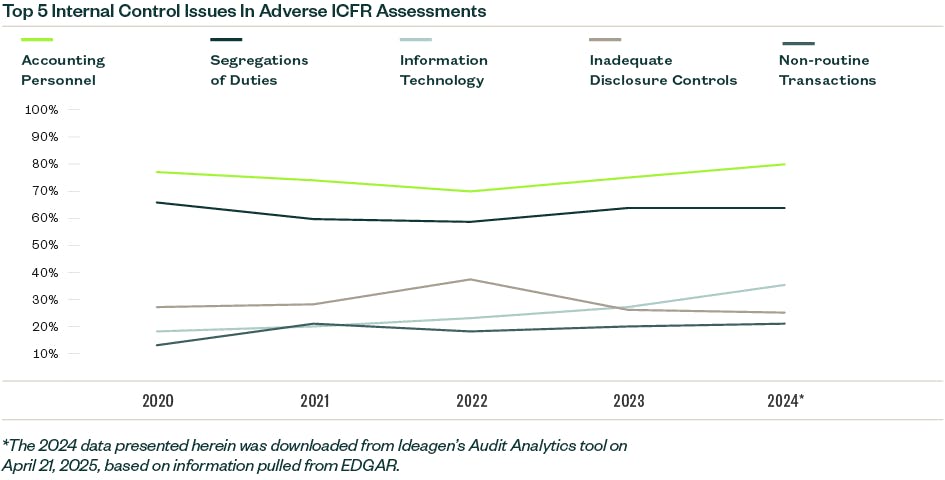

Recent data collected from the SEC's EDGAR database through April 21, 2025, provides valuable insights into the current state of material weaknesses reported by public companies.

Leverage key SEC material weakness findings and emerging trends that can provide guidance for management and auditors with the following insights and analysis.

Public company material weakness reporting: Overview

The Sarbanes-Oxley Act (SOX) mandates two primary requirements under Section 404:

- SOX 404(a). Management must assess the effectiveness of the company's internal control over financial reporting (ICFR).

- SOX 404(b). Registered public accountants must attest to, and report on, the effectiveness of the company’s ICFR.

Our analysis encompassed over 5,000 management-only assessments and more than 3,000 external auditor assessments from companies filing between 2020 and 2024.

The data reveals significant trends in the prevalence of material weaknesses, particularly in the wake of the special purpose acquisition company (SPAC) boom and subsequent regulatory scrutiny.

Key trends in public company material weakness reporting

Increase and subsequent decline in material weaknesses

The data indicates a notable spike in material weaknesses reported in 2021 and 2022, with over 26% of filers reporting adverse assessments in 2021. This trend can be largely attributed to the influx of companies going public through SPACs during this period, many of which encountered significant internal control deficiencies. However, the adverse reporting rate has since declined, dropping to just over 15% in 2024.

This downward trend suggests that companies are increasingly addressing their internal control weaknesses and improving their compliance frameworks. It also indicates that companies going public in recent years are more prepared to meet internal control requirements.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.