The annual Medicare cost report is a critical document for cost-based reimbursed providers, such as critical access hospitals, whose payments are based on this report.

According to the Centers for Medicare & Medicaid Services (CMS), “Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data.”

On Aug. 26, 2020, the CMS released updated information in the Medicare Fee-for-Service Billing FAQ document. Prior to that, there wasn’t clear guidance on how the Provider Relief Fund (PRF) and other COVID-19-related financial benefits, such as payroll tax deferral, would be treated on the cost report.

Background

The PRF is $175 billion authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) act and the Paycheck Protection Program and Healthcare Enhancement Act.

The PRF has been given to healthcare providers in various distributions, starting on April 10, 2020, as well as via claims-submission to the Uninsured Program. Medicare- and Medicaid-enrolled providers are generally eligible for a payment of 2% of their annual patient revenue, plus any additional targeted allocations that may be applicable. Rural providers or nursing homes, among others, are examples of those that were eligible.

Medicare cost report guidance

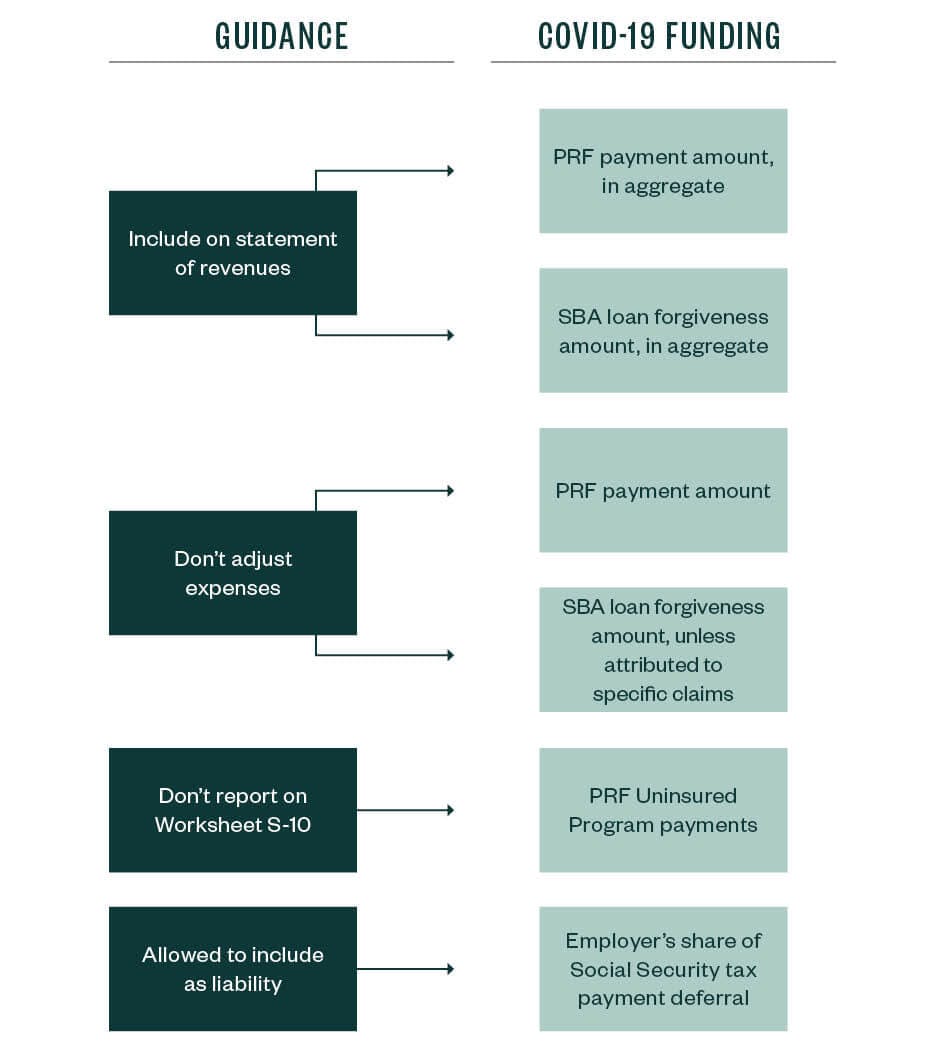

Following is a breakdown of how to report COVID-19 funding on your cost report.

PRF payment amount

Providers must report PRF payments in aggregate on the statement of revenues, and the revenue amount must be classified as “COVID-19 PHE PRF.”

For a comprehensive list of PRF program payments that should be reported in the category, please refer to the

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.