This tax year is a good time to start planning charitable giving.

The tax benefit of charitable giving could vary substantially, depending on the techniques used and the impacts of tax code changes. Below, we’ll analyze and compare two popular methods of giving. This will help you determine tax impact so you could capitalize on the tax benefit.

What are the most popular methods of tax-efficient charitable giving?

Charitable giving usually involves cash because it’s the simplest approach; however, it could be an inefficient means of giving from a tax perspective. The best approach starts with talking with your tax and financial advisor team about what will work best for you.

There are multiple options for giving assets, including gifts of appreciated securities, qualified distributions from your IRA, and charitable trusts. Knowing about your charitable giving vehicle options could help you give even more tax efficiently.

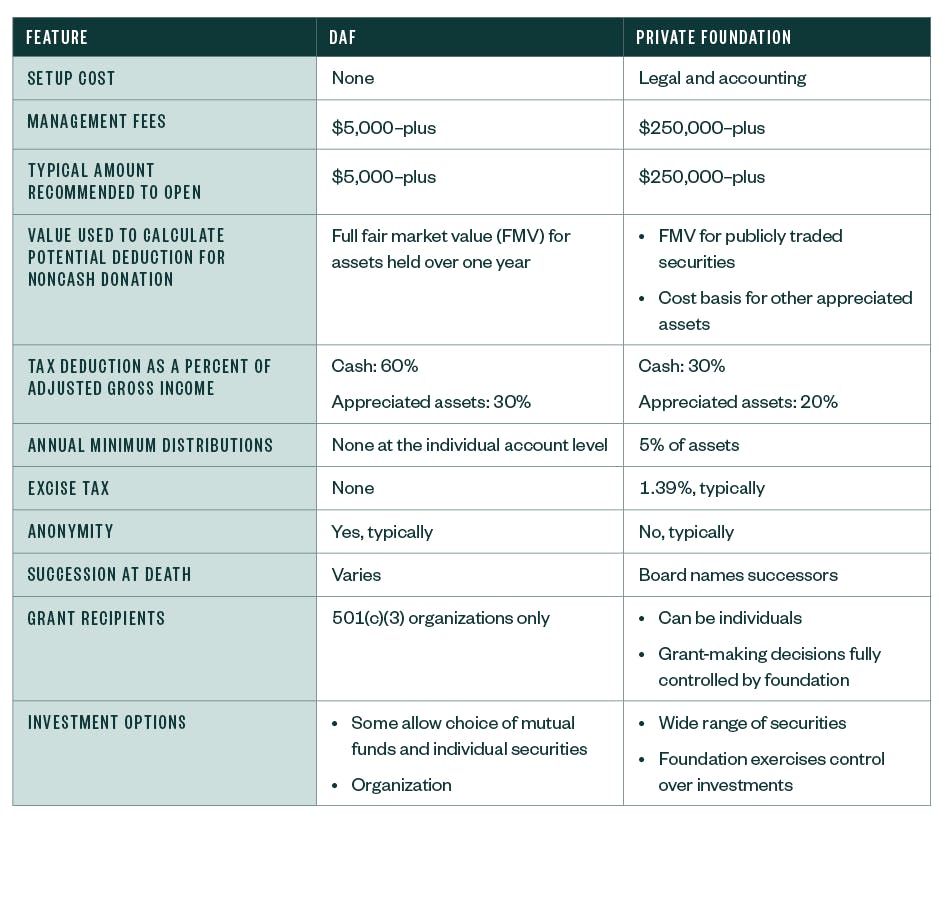

The two most popular charitable giving vehicles are donor-advised funds (DAFs) and private foundations.

What is a donor-advised fund?

DAFs let you gift cash, appreciated securities, and other appreciated assets to the charitable organization. The fund then gifts the value of your gifts, over a time period, to the charitable organizations you designate.

DAFs can be useful if you want to make a contribution, and need a current-year tax deduction, but you’d like time to decide where the money will go. You can make a gift now, and the DAF holds the assets until you’re ready to distribute to a charity.

However, it’s important to remember, most sponsoring organizations of DAFs have a time limit as to how long you can go without making a charitable distribution, and a DAF requires giving to be to a 501(c)(3) public charity such as American Red Cross, houses of worship, and educational institutions.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.