Clean energy-related projects could help your organization reduce its energy costs, increase cash flow, and receive cash in the form of a refundable tax credit.

What is a refundable tax credit?

A refundable tax credit is a type of tax incentive that allows organizations to reduce their tax liability and receive a cash refund if the credit exceeds the amount of taxes owed.

What is IRC 6417?

Under the Inflation Reduction Act, Internal Revenue Code (IRC) Section 6417 established a mechanism for applicable entities to treat certain energy tax credits as a payment against their federal income tax by making what the IRS terms as an elective payment.

This is referred to within the industry as direct pay. For projects placed in service after Jan. 1, 2023, direct pay makes certain clean-energy tax credits eligible for a cash refund.

Who does IRC 6417 apply to?

The following applicable entities could be eligible for this refundable tax credit.

Entities that could qualify for IRC 6417

What projects qualify for IRC 6417?

Credits generated from the following types of technologies, among others, qualify for elective payment for applicable entities.

Qualifying projects for IRC 6417

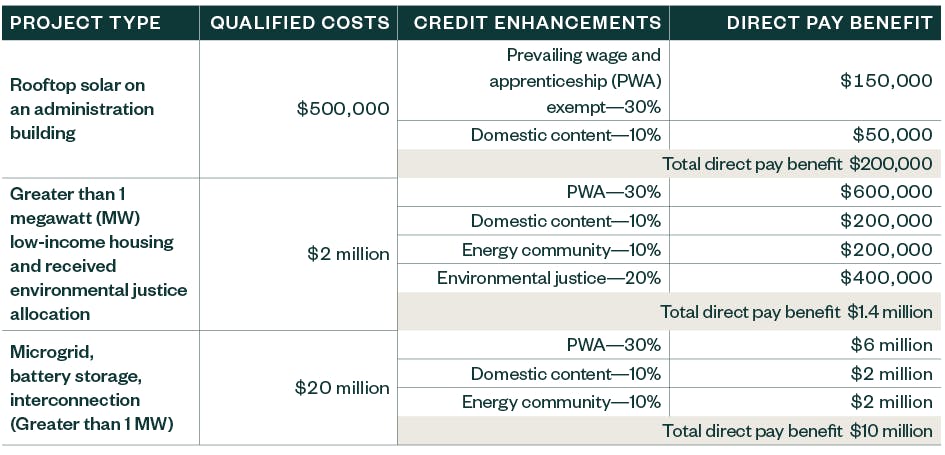

Examples of Inflation Reduction Act projects and benefits

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.