Corporate Renewal & Turnaround Services

When your business is faced with performance challenges and the environment is uncertain, Baker Tilly’s turnaround professionals offer the experience, skills and insights necessary to be a guiding force in your turnaround and corporate renewal.

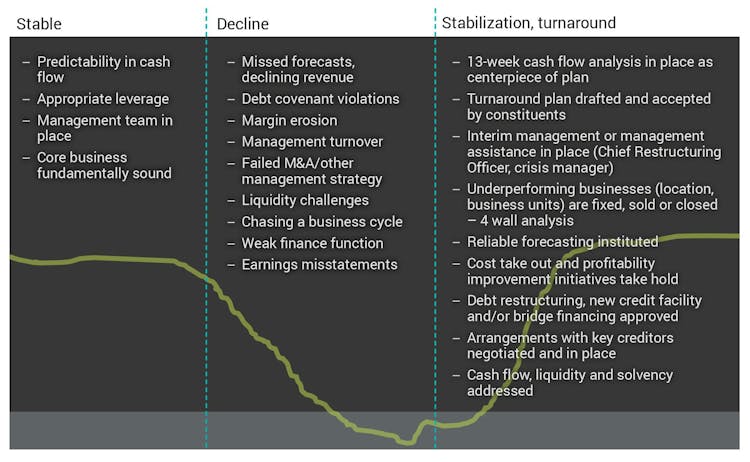

Prior to March 2020, the U.S. economy was experiencing the longest economic expansion in history. A period that culminated into peak earnings and peak leverage. All the hallmarks were in place: significant merger and acquisition (M&A) activity, recapitalizations, initial public offerings (IPOs), new start-ups and general growth investments. Business plans and capital structures were set for continued growth. However, the economic landscape has shifted notably since then. Elevated interest rates have persisted longer than many companies anticipated, while labor shortages and inflationary pressures continue to impact operational costs. Many businesses are grappling with over-leveraged structures that struggle to cope with ongoing interest expenses and rising costs. These evolving challenges underscore the need for strategic corporate renewal and turnaround solutions to navigate the complexities of today’s business environment.

Along with figuring out how to keep their employees and customers safe, otherwise successful businesses are now confronted by:

- Liquidity challenges

- Inability to forecast

- Debt covenant violations

- Management turnover

- Misaligned or bloated cost structures

- Financial reporting challenges

Companies could also be facing distress due to labor shortages, strikes, natural disasters, seasonal fluctuations, market saturation, incorrect financial forecasting, high development expenses, obsolete portfolios, insufficient investments, or deficient quality or management control.